Here you will find a selection of articles, papers, media links, and sites that capture our intellectual capital and perspectives, as well as those of some of our most trusted partners and colleagues in the industry. We firmly believe in open-source insight and gladly share this material in the hope of advancing the market embrace of the principles of sustainable investing.

A number of these articles appear in Citywire USA Professional Buyer magazine and are included here for convenience. Most if not all of them are available in electronic form for free from Citywire at their website. Please consider becoming a free subscriber to either the print magazine or website to read this and other excellent content.

RIS Paper – Slapped by the Invisible Hand Aug. 6, 2020

Leaving only 30 days to comment, the Employee Benefits Security Administration under the US Department of Labor proposed, on June 30, 2020, a rule change to Title I of ERISA “to confirm that ERISA requires plan fiduciaries to select investments and investment courses of action based solely on financial considerations relevant to the risk-adjusted economic value of a particular investment or investment course of action.”

Leaving only 30 days to comment, the Employee Benefits Security Administration under the US Department of Labor proposed, on June 30, 2020, a rule change to Title I of ERISA “to confirm that ERISA requires plan fiduciaries to select investments and investment courses of action based solely on financial considerations relevant to the risk-adjusted economic value of a particular investment or investment course of action.”

This paper discusses the implications of the proposed rule, but departs from a discussion of the investment merits of ESG strategies and focuses on the structural problems the DOL would introduce by carving out ESG as a special class of investment held to a unique and elevated standard as compared to all other “traditional” investment options.

TIIP Sustainable Investment Products and Due Diligence

More than a quarter of assets under management (AUM) worldwide are invested in “sustainable” strategies, and investors—both individual and institutional and at all wealth levels—are increasingly interested in integrating these strategies into their financial plans and investment portfolios. In response, many asset managers are expanding their sustainability-related services to grow their businesses. These managers are developing various sustainability strategies and associated services and increasingly participating in related industry activities.

More than a quarter of assets under management (AUM) worldwide are invested in “sustainable” strategies, and investors—both individual and institutional and at all wealth levels—are increasingly interested in integrating these strategies into their financial plans and investment portfolios. In response, many asset managers are expanding their sustainability-related services to grow their businesses. These managers are developing various sustainability strategies and associated services and increasingly participating in related industry activities.

All this activity is welcome and needed. But as asset managers get more and more involved in sustainable investing, due diligence officers, financial consultants, investment staffs, fund trustees, and others must ask themselves: Which managers are doing the best job providing sustainable investment services, whose approach is the most effective, and who provides the best fit for their needs?

This report, Sustainable Investment Products and Due Diligence, is designed to prompt further dialogue on the nature and types of sustainability products on the market and to identify questions that arise in assessing their quality and success. Developed by The Investment Integration Project (TIIP) in partnership with the Money Management Institute (MMI) and with support from Thornburg Investment Management, it is intended to serve as a stepping stone along the pathway to the development of needed due diligence procedures for this growing investment discipline.

“Déjà Vu” — Citywire USA Professional Buyer April 2020

For those of us who have been in this business for a few decades, there is a punch-drunk feeling to this bout with the new strain of coronavirus, Covid-19. Wind back the clock seven years or so — we were dealing with Superstorm Sandy. Before that, the financial crisis. Seven years before that, the tech collapse and 9/11 back to back. Those are just the standout lowlights over 20 years, and each had lasting consequences for society, infrastructure and markets.

For those of us who have been in this business for a few decades, there is a punch-drunk feeling to this bout with the new strain of coronavirus, Covid-19. Wind back the clock seven years or so — we were dealing with Superstorm Sandy. Before that, the financial crisis. Seven years before that, the tech collapse and 9/11 back to back. Those are just the standout lowlights over 20 years, and each had lasting consequences for society, infrastructure and markets.

Where does ESG fit in all of this?

Two key recurring themes throughout sustainable and responsible investing are the concepts of mitigation and resilience. How do you prevent or at least attenuate problems or full-blown crises and how do you bounce back when presented with the unavoidable? [follow this link for PDF of the full article]

“What’s your ESG Decree” — Citywire USA Online March 2020

A key stress gatekeepers are forced to wrestle with in vetting strategies and building out a menu or model of ESG-aligned funds or separate account strategies is one of philosophical orientation, or really, in our more common parlance, style. Outside of the ESG realm, we have all taken a big-tent approach to curating a list of managers, with room for the macro and the behavioral, value and growth, investment grade and junk, fundamental and quantitative, and so on. There is similarly no one universal ESG good, and in fact a diversity of approaches may actually be healthy for diversified portfolios and markets. [follow this link for PDF of the full article as it appeared on the Citywire USA Pro Buyer website]

“Disappearing Dollars” — Citywire USA ESG Special Supplement March 2020

‘If, by the end of 2017, already one in every four professionally managed dollars in the US was identified as sustainably, responsibly and/or impactfully invested, who has all those assets? Because we don’t.’

‘If, by the end of 2017, already one in every four professionally managed dollars in the US was identified as sustainably, responsibly and/or impactfully invested, who has all those assets? Because we don’t.’

This is a question that has, in some variety, been put to just about every champion of sustainable investing at internal meetings. Other versions of the same question have included asking, based onthe one-in-four number, why dedicated ESG shops are not bigger? Or why the adoption rate by financial advisors is still so low? In short, where is the money? [follow this link for PDF of the full article]

“Declaration of Intentions” — Citywire USA March 2020

Intentionality, the best-practice quality in ESG and impact investing, is where capital is allocated purposefully to be exposed to, participate in or catalyze positive change. But, as the aphorism goes, the road to hell is paved with good intentions. How then, as a gatekeeper, does one assess substance of stated intentions to assure there is more than deliberate or accidental ‘greenwashing’? [follow this link for PDF of the full article]

“Nero Fiddled While Australia Burned” — Citywire USA February 2020

At 5am on December 15, 2019, António Guterres, Secretary-General of the United Nations, wrote on Twitter: ‘i am disappointed with the results of #COP25. The international community lost an important opportunity to show increased ambition on mitigation, adaptation and finance to tackle the climate crisis. But we must not give up, and I will not give up.’

If it was not already obvious, the planetary clock is pushing midnight while we wait for government and intergovernmental bodies to solve the climate crisis. Guterres left the United Nations Climate Conference (COP25) in Madrid acknowledging that the convening members fell short of the mark. [follow this link for PDF of the full article]

“Smoke and Mirrors” — Citywire USA December 2019

How many clichés can we throw at this? What’s good for the goose is good for the gander. Judge not lest ye be judged. Maybe people who live in glass houses should not throw stones?

Financial consumers of all stripes, from individuals to institutions, who fold ESG considerations into how they assign wealth and asset management mandates are looking more and more comprehensively at the entirety of the financial services supply chain for consistency with their guiding principles. The idea of a supply or value chain is a recurring theme in equity and bond analysis, and takes on an even deeper meaning when ESG considerations are added. Oddly though, the critical analysis of the entire supply chain behind an investment product is not broadly practices in ESG due diligence, even though it is ubiquitous in evaluations of the underlying portfolio securities. [follow this link for PDF of the full article]

“Collateral Damage” — Citywire USA October 2019

How impaired are your equity portfolios due to ESG externalities? Okay, maybe first, what is an ESG externality? Let’s start with Merriam-Webster’s dictionary definition: ‘a secondary or unintended consequence.’ Could you use it in a sentence? ‘The opioid crisis is an externality that has come home to roost for pharmaceutical companies.’

How impaired are your equity portfolios due to ESG externalities? Okay, maybe first, what is an ESG externality? Let’s start with Merriam-Webster’s dictionary definition: ‘a secondary or unintended consequence.’ Could you use it in a sentence? ‘The opioid crisis is an externality that has come home to roost for pharmaceutical companies.’

More informally, we can think about ESG externalities as the things that seem to matter to everyone else but not to the companies creating them. As communities and societies, we are dealing with corporate externalities every day. Increasingly, investors are having to deal with externalities as portfolio considerations as well. These are outcomes that have tangible negative impacts on the planet and society as well as being unpriced risks to the companies creating them. [follow this link for PDF of the full article]

“Breaking Free” — Citywire USA September 2019

Imagine for a moment that, right now, the entire state of California is enslaved. Imagine that 71% of those people are female and one in four are children. Imagine that 61% of all enslaved people are in forced labor.

This is not a pitch for some dystopian Hollywood flick. These are statistics from the 2018 Global Slavery Index (GSI). Globally, 40.3 million people, roughly the equivalent of the population of California, were estimated to be trapped in slavery in 2016.

According to the International Labour Organization, 16 million people are currently being exploited in the private sector. And, says the GSI, when considering the top five products important by the G20 every year, $354 billion worth of products are estimated to be ‘at risk of being produced by modern slavery.’ [follow this link for PDF of the full article]

“Pulled in Many Directions” — Citywire USA July 15, 2019

What’s that saying about good intentions? When ESG-minded clients seek investment solutions that take into account more than just asset class exposure and risk-adjusted return, gatekeepers are tasked with reconciling the competing priorities of economic and non-economic factors. An intelligently constructed portfolio should be able to align the priorities of most stakeholders, and ideally, that alignment should then become self-reinforcing.

What’s that saying about good intentions? When ESG-minded clients seek investment solutions that take into account more than just asset class exposure and risk-adjusted return, gatekeepers are tasked with reconciling the competing priorities of economic and non-economic factors. An intelligently constructed portfolio should be able to align the priorities of most stakeholders, and ideally, that alignment should then become self-reinforcing.

That’s the one true dream in ESG land, having built a fully aligned and integrated portfolio. However, there are some stakeholder priorities that many never perfectly align, and when evaluating managers in ESG terms, this issue of alignment raises a broader question: How should gatekeepers go about identifying those dissonances and determining which trade-offs are acceptable and appropriate? [follow this link for PDF of the full article]

“A Confusion of Tongues” — Citywire USA June 3, 2019

The accepted wisdom is that we are awash in a sea of terms and acronyms that all more or less mean the same thing: ESG, sustainability, impact, SRI, socially conscious investing, values-based investing and so on.

The accepted wisdom is that we are awash in a sea of terms and acronyms that all more or less mean the same thing: ESG, sustainability, impact, SRI, socially conscious investing, values-based investing and so on.

But wait — somehow, the accepted wisdom is also that ESG and sustainability are economic disciplines examining the benefits of environmental, social and governance considerations on business operations, community services and securities analysis. By contrast, impact, SRI or socially conscious investing are seen as forms of extra-financial considerations that may come at an economic cost when incorporated into a portfolio.

Can both sets of assumptions be true? [follow this link for PDF of the full article]

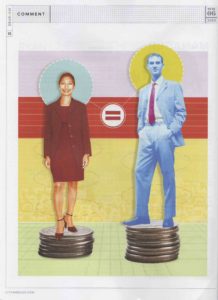

“Equal Pay for Equal Work” — Citywire USA May 6, 2019

According to the National Women’s Law Center, the overall wage gap for women over the past decade has remained steady at about 80 cents for every dollar earned by men. That translates to about 64 extra work days per year for women to reach pay parity.

According to the National Women’s Law Center, the overall wage gap for women over the past decade has remained steady at about 80 cents for every dollar earned by men. That translates to about 64 extra work days per year for women to reach pay parity.

This gap is even bigger for Latinas, black women and women of Native American and Hawaiin descent, requiring the impossibility of working for more days than exist on the calendar to break even.

…As issues of economic inequality have finally made it into the investment mainstream, more data has become available. This makes it possible to examine corporate and community performance in gender terms. Along with that, we have also seen the rise of Gender Lens Investing (GLI) as either a standalone strategy or a facet of broader ESG mandates.

Unfortunately, in strictly quantitative terms, the data has proved insufficient in the equity space to capture performance beyond basic metrics of gender inclusion in the workforce and in leadership. [follow this link for PDF of the full article]

“Small Steps & Giant Leaps” — Citywire USA March 25, 2019

Is the Green New Deal compatible with the free market? And — let’s remember why we’re here — is it investable? The short answers are yes and yes, and the ideas contained within it are not particularly revolutionary if you have spent any time looking at ESG investments.

In short, the Green New Deal — a series of legislative proposals for economic stimulus programs, intended as a way to tackle climate change and inequality — seeks to eliminate greenhouse gas emissions, create jobs and build sustainable infrastructure, all while securing clean air and water, healthy food, resilience in both the climate and communities, access to nature, and justice and equity for all.

None of these are new or outlandish ideas, and they actually mesh pretty well with the UN’s Sustainable Development Goals, which set out targets for a more sustainable planet by 2030. [follow this link for PDF of the full article]

Click here for the text of HR 109 of the 116th Congress “Green New Deal”

“ESG and EM” — Citywire USA Feb 25, 2019

For most of the history of ESG and responsible investing, emerging markets have stood just beyond the pale — both theoretically and practically. Challenges have ranged from issues with market transparency and a simple lack of data to out-and-out corruption.

As a result, many investors in listed securities have tended just to skip that part of the asset allocation. Even the most intrepid impact-focused investors out there generally avoid the public markets by turning instead to direct equity investments and microfinance, which are out of reach for most retail investors.

However, with new ESG strategies coming to market in a variety of structures, it may be time to reassess that. [follow this link for PDF of the full article]

“Got the Message” — Citywire USA Jan 28, 2019

New year, new start. It’s time to put aside the festive feeling to talk instead about raw, unadulterated capitalism and ESG.

Most of you will recognize the familiar objection to ESG — that focusing on the environment and human dignity is at odds with making money There is ample blame to go around when it comes to the question of why that perception exists, but it’s actually very difficult to point the finger at the realities of allocating capital, managing risk and operating businesses.

Practitioners in the ESG space deserve a share of the blame here. [follow this link for PDF of the full article]

“Time to Get Personal” — Citywire USA Nov 19, 2018

Intimacy. It’s a word that makes most of us squirm — particularly in financial services.

Some of the most effective financial advisors and consultants are those who can establish contextual intimacy with their clients and then constantly keep in mind that they must not betray this trust by being cavalier or self-serving in search of business…

…As ESG investing has moved toward the mainstream, a fair number of asset managers have focused solely on the investment case and have steered away from discussing the personal or mission-driven aspects of the investment experience. [follow this link for PDF of the full article]

Fourth National Climate Assessment — Report in Brief

(Excerpt from the NCA Report in Brief — the full NCA4 can be found at nca2018.globalchange.gov)

The Global Change Research Act of 1990 mandates that the U.S. Global Change Research Program (USGCRP) deliver a report to Congress and the President no less than every four years that

1) integrates, evaluates, and interprets the findings of the Program

2) analyzes the effects of global change on the natural environ- ment, agriculture, energy production and use, land and water resources, transportation, human health and welfare, human social systems, and biological diversity; and

3) analyzes current trends in global change, both human-induced and natural, and projects major trends for the subsequent 25 to 100 years.

The Fourth National Climate Assessment (NCA4) fulfills that mandate in two volumes. This report, Volume II, draws on the founda- tional science described in Volume I, the Climate Science Special Report (CSSR). Volume II focuses on the human welfare, societal, and environmental elements of climate change and variability for 10 regions and 18 national topics, with particular attention paid to observed and projected risks, impacts, consideration of risk reduction, and implications under different mitigation pathways. Where possible, NCA4 Volume II provides examples of actions underway in communities across the United States to reduce the risks associated with climate change, increase resilience, and improve livelihoods.

This assessment was written to help inform decision-makers, utility and natural resource managers, public health officials, emergency planners, and other stakeholders by providing a thorough examination of the effects of climate change on the United States.

“Is ‘Believe in Something’ Something to Believe in?” — Citywire USA Oct 9, 2018

What role does a brand ambassador or social media influencer play in informing an investor’s perception of a company’s track record on ESG? In years gone by, good marketing and advertising were all about appealing to as broad a swath of the public as possible, with subtle nods toward specific market segments in an attempt to convey a certain product, message or image. It always used to be a question of creating an opportunity for the customer to identify with the company, the product and the brand without turning everyone else off. But now – particularly in light of the rise of the millennial consumer – large companies are having to retrench and retool to stay relevant in a new age. Tastes are more particular these days, and being artisanal, boutique or undiscovered is suddenly a virtue. [follow the link to read the article as a PDF here or on CityWire USA’s site here]

“Meet Your Friendly Neighborhood Investor” — CityWire USA Sept 10, 2018

Investors face a challenge when trying to apply their sustainable consumer behaviors to their portfolios. Living small — which manifests itself in a number of behaviors and under many labels — basically means shrinking your environmental and societal footprint from a consumption point of view and can also involve localizing and increasing your leverage in terms of positive impact. [follow the link to read the article]

“The Power of Now” — CityWire USA July 30, 2018

Cultivating ESG adoption among advisors and asset owners is difficult enough at the best of times, what with the constant battle against the tired trope of performance concerns. Failing to tap into a sense of urgency and relevance, then, really would be shooting yourself in the foot. [follow the link to read the article]

“Divisive Divestment” — CityWire USA July 2, 2018

BDS. Three letters that are fraught with as much nuance, complexity and contention as any idea in or around the ESG firmament. According to the Palestinian BDS National Committee, it stands for ‘Boycott, Divestment, Sanctions’ — a non-violent movement targeting action over apartheid, human rights violations, property rights and other concerns in the remaining occupied territories from the Six Day War (1967)… Socially responsible investing (SRI) has very firm roots in the legacy of corporate action — boycotts and divestments — to bring about change in South Africa. Does BDS therefore automatically have a place in core ESG policy, and has it been incorporated directly into investment processes? [follow the link to read the article]

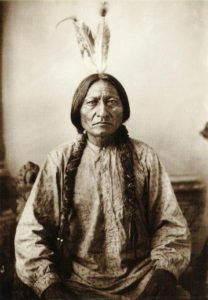

“Righting Wrongs” — CityWire USA May 21, 2018

…Native American history truly is a trail of tears, punctuated by the theft of land and life to the point of genocide — and the subsequent marginalization of those who remained. Somehow, in 2018, sacred lands and fresh water supplies are still being soiled and stolen in places such as Bears Ears and Standing Rock — all supposedly in the name of the public interest and corporate profit. Natural resources continue to drive much of this behavior, almost 170 years after the California Gold Rush began.

…Native American history truly is a trail of tears, punctuated by the theft of land and life to the point of genocide — and the subsequent marginalization of those who remained. Somehow, in 2018, sacred lands and fresh water supplies are still being soiled and stolen in places such as Bears Ears and Standing Rock — all supposedly in the name of the public interest and corporate profit. Natural resources continue to drive much of this behavior, almost 170 years after the California Gold Rush began.

The question here is how a portfolio manager can incorporate these types of issues into an ESG-centric investment process, and how a gatekeeper would ultimately evaluate that process and the portfolio’s outcomes. [follow the link to read the article]

“Loaded Issue” — CityWire USA April 23, 2018

In the era of managed money, clients are calling less and less frequently when they see performance go up and down on news. However, they ar still calling based on what they see in the news. It’s just that it’s not the business report at the bottom of the hour that’s making them call. It’s the headlines at the top of the hour.

The modern age of mass shootings began 20 years ago at Westside Middle School in Jonesboro, Arkansas. Next came Columbine, Virginia Tech, a movie theater in Aurora, Colorado, Sandy Hook, the Emanuel AME church in Charleston, South Carolina, the Pulse nightclub in Orlando, the Las Vegas Harvest Music Festival and most recently, Marjory Stoneman Douglas High School.

…So why have the weapons and munitions manufacturers involved — directly or indirectly, voluntarily or involuntarily — not been punished by the market? [follow the link to read the article]

“What Use is a Green Yardstick?” — CityWire USA March 26, 2018

For a number of years, in evaluating and selecting ESG managers, I have had to wrestle with the question of what the appropriate basis for benchmark comparison should be. It was a quick debate because there just were not very many choices. Since then though, and to the benefit of the industry, providers and indexes have proliferated to the point there is a methodology, formula or filter for almost any angle on ESG, at least in the public equity space. [follow the link to read the article]

“Watch Out for (ESG) Drift” — CityWire USA February 26, 2018

It has been a while since we have seen real bi-directional volatility in the market. In the past week it has felt like there are no safe and secure places to hide other than under the sheets with flashlights. By the time this article is published, this bout of volatility will either have proven as fleeting as other episodes over the last several years, or will have blossomed into a full-on correction in the markets. Where the market went, or may go, is not the root of this month’s discussion. How ESG managers react(ed) is. [follow the link to read the article]

“#TooMany” — CityWire USA January 29, 2018

Over the past 100 days, #MeToo has been the headline and the hashtag every time someone who has been abused in a professional setting has exacted a tiny measure of justice from the mighty and the apparently inscrutable. Men in positions of considerable power and prestige are finally being held to account for misusing that power in ways that are demeaning, demoralizing and disgusting to the professionals – overwhelmingly women, but men as well – who work alongside them. The movement was thrust into the limelight by Alyssa Milano’s tweets in October, but #MeToo, casting light on the pervasiveness of assault and abuse at the other end of the economic spectrum, began with Tarana Burke, the founder of not-for-profit youth organization Just Be Inc., back in 2006. The problem, though, is as old as the dirt under our feet. [follow the link to read the full article]

“The Obvious Choice – Genocide-Free Investing” — CityWire USA December 4, 2017

Is there corporate activity so egregious it transcends the concerns of just environmental, social and governance (ESG)-oriented asset owners and managers and becomes the broader responsibility of all market participants? And if so, how should the market go about addressing it? According to a 2010 study conducted by KRC Research, a unit of Interpublic Group, nearly nine in 10 survey participants agreed, and seven in 10 completely agreed, with the statement: ‘I would like my mutual funds to be genocide-free.’ Surprisingly given how decisive that response was, the same study indicates that seven in 10 did not even know that some mutual funds are invested in companies that are identified as funding genocide in places like Sudan. It therefore makes sense that, by similar margins, participants also support mandatory disclosure by funds of such holdings. Extrapolating from the KRC study and assuming minimum overlap between those who do not know and those who would not own, at least four in 10 might be likely to divest of funds owning companies of concern if they knew about them.

Genocide is not an issue with two meritorious points of view. There are no mitigating conditions. Not to oppose it is to stand on the wrong side of humanity and the wrong side of history. But, how to address it in the capital markets is not nearly so black-and-white. [follow this link for the print version and this link for the long-form online version]

“Reaching Far & Wide” — CityWire USA November 20, 2017

The yawning gaps in a globally allocated environmental, social and governance (ESG) portfolio are finally starting to close as resources and processes are developed to deal with challenging asset classes and markets… But, with the enhancement of global asset coverage, analysts evaluating new ESG managers have to recalibrate and in some cases reframe their analysis in order to discern whether these newly available strategies are merely better than nothing or truly commensurate with the seasoned strategies occupying the rest of the asset map. [follow the link to read the full article]

The US Global Change Research Program’s Fourth National Climate Assessment — The Climate Science Special Report has been developed as part of the USGCRP’s sustained National Climate Assessment process. This process facilitates continuous and transparent participation of scientists and stakeholders across regions and sectors, enabling new information and insights to be assessed as they emerge. The Climate Science Special Report conducted a comprehensive assessment of the science underlying the changes occurring in Earth’s climate system, with a special focus on the United States. [CSSR2017 Full Report and Executive Summary]

“Broken Bonds” — CityWire USA October 23, 2017

Well-managed debt can be empowering for individuals, families, companies and communities. Indeed, equal access to borrowing is a critical part of economic justice, and there are certainly plenty of environmental, social and governance (ESG)-minded reasons to own bonds. [follow the link to read the full article]

“Finding the ‘S’ in SRI” — CityWire USA, September 11, 2017

Like the new kid in school who hopes not to be bullied on the playground, environmental, social and governance (ESG) investing has done everything it can to fit in with the crowd. … In the process of recasting it, though, we have lost some of its essential and distinctive qualities. [follow the link to read the full article]

“Feel the Heat” — CityWire USA, July 17, 2017

As I write this the Department of Labor (DOL)’s fiduciary rule is once again in limbo. While some parts of it have come into force, it could yet be revised, rescinded or shoved further back on the shelf.

But while the feds fiddle, Rome does not burn. States are taking it upon themselves to act… [follow the link to read the full article]

“In ESG We Trust” — CityWire USA, June 19, 2017

Is a sense of duty to take environmental, social and governance (ESG) factors into consideration when deploying investable capital ever at odds with fiduciary responsibilities? [follow the link to read the full article]

“A Rose By Any Other Name” — CityWire USA, May 8, 2017

Does wearing a flag pin make someone a patriot? Are chicken eggs labeled ‘organic’ in the grocery store by definition farmed in an environmentally responsible and humane way? On the 10th anniversary of its founding, I ask if signing on to the United Nations Principles for Responsible Investment (PRI) is sufficient to identify a financial services firm as sustainable and its offerings environmental, social and governance (ESG) compliant. [follow the link to read the full article]

“Let them eat carrot cake” — CityWire USA, April 10, 2017

Thematicism has always had a comfortable home in ESG-space. Sustainably invested portfolios have been a fertile ground for big ideas – gender equity, rights of indigenous peoples, fossil fuel divestiture, and economic justice as examples. In some cases, these themes inform security exclusion or engagement activity, and in others might drive idea generation and support ownership theses. In the past it was rare to find portfolios and funds that occupied a single vertical ESG-sourced theme. Strategies would embody some combination of sustainability and impact themes and attempt to reconcile competing priorities and occasionally outright conflict between big ideas, like addressing nutritional insufficiency and GMOs, or low-carbon power generation and nuclear energy. [follow the link to read the full article]

“Revisiting the classics” — CityWire USA, March 13, 2017

It really feels like the market for sustainable and responsible investing has come full circle. The roots of this style of investing can be traced back to a variety of religious and values-based as well as societal and environmental movements. Whether it was businesses rooted in traditional vices like gaming, alcohol and tobacco, or exposed to bigger issues such as South African apartheid, portfolios were built by first eliminating from consideration companies too deeply entangled in these areas of concern. The economic motivation on the part of investors may have been not to profit from certain businesses and business practices, or it might have been a more active effort to deprive those businesses of access to capital, but it amounted to the same thing – divestiture. [follow the link to read the full article]

“Navigating the Moral Maze of Impact Investing” — CityWire USA, January 30, 2017

Impact investing has, in the past couple of years, become the new ‘it girl’ of sustainable public-market investment. It’ll take several more articles to unpack all of the challenges of translating the concepts and language of private-market impact into the pub space. Fortunately, from an analyst’s perspective, impact needs to be material and measurable, which puts it squarely in the intellectual wheelhouse of traditional manager due diligence. Material and measurable intentionality, which I touched on previously, is also essential. So, how do we discern the difference between principled and productive impact and window-dressing? [follow the link to read the full article]

“Tools of the Trade” — CityWire USA, January 2017

The question on the table now is one of how to actually evaluate intentionality in an investment process. The Investment Integration Project (TIIP) just released their latest report, ‘Tipping Points 2016’, a systems-level study of asset owners and managers in the sustainable investment space. Section two of that report is entitled ‘The 10 Tools of Intentionality’. It was a holiday miracle. This column was going to unpack how to identify and assess intentionality, and the elves came in, did my homework, and polished my shoes on their way out. [follow the link to read the full article]

“Best in Show” — CityWire USA, December 2016

Much of the criticism heaped upon socially responsible investing (SRI) strategies over the last two decades is rooted in the realities and fallacies about the effects of portfolio exclusion. Concerns include performance deficits, high sector concentration, style and regional biases, and unconstrained tracking error. ESG investing, which could be viewed as SRI 2.0, has sought to address some of those real and perceived obstacles through a more inclusionary approach to portfolio construction. Instead of screening out the worst offenders, include “best-of-breed” companies across the economy. We can find a variety of implementations of best-of-breed, some of which incorporate issue- or involvement-based screens to construct an ESG-ready universe as a preamble to bottom-up security selection. Others eschew exclusions and will conceivably own any company or security provided it is the “best” in relative economic and ESG terms against its asset class, sector, or industry. [follow the link to read the full article]

“Did I Do That?” — CityWire USA, November 2016

On what basis does an analyst, an advisor or an investor decide on the environmental, social and governance (ESG) merits of an investment strategy? In my last article I suggested a research and due diligence framework for these strategies that requires comparison in the broad universe of investment options and against the same suite of traditional quantitative and qualitative metrics. I left off saying “…overlay that coverage with robust analysis to be certain they approach ESG with the level of thoughtfulness and authenticity in sustainability terms that clients require.” In a resource-constrained environment that is easier to say than to execute. [follow the link to read the full article]

“Gatekeeper’s Dilemma” – CityWire USA, October 2016

I have spent a large part of my career leading manager research and multi-manager portfolio model and construction teams in both asset management and wealth management settings. As a product of assessing hundreds of boutiques and teams I have developed a methodology and a set of criteria for deconstructing investment processes and portfolios in quantitative and qualitative terms — to evaluate relative and absolute “goodness”, discipline, transparency, and systematic risk management. It is almost an embarrassment of riches with thousands of managers and tens of thousands of strategies in the universe. Any given category of any substance has dozens if not hundreds of competitive options. If a strategy under due diligence does not seem to be standing up to scrutiny, move on to the next one. If a thesis is not playing out, sell and move on to the next one.

But, what if the gatekeeper — a research director, a fund-of-funds manager, a consultant — is faced with an asset space where there are a scant few options, or maybe only one? [follow the link to read the full article]

Mom and Dad would be proud. It only took 24 years from when I received my Bachelor of Music degree to locate the convergence between fine arts and sustainable finance. Sustainable practices in entertainment and media are perhaps not as obviously critical as they might be in extractive industries, food services, or manufacturing. What is clear through closer examination, is that the entertainment and media sectors serve as a laboratory for considering central sustainability themes around intellectual and human capital. A great song or a well-written play might not cure a disease or feed a nation, but, from the Marriage of Figaro to Pussy Riot, could inspire a movement or bring down a government as surely as they can amuse or entertain. Music, theatre, and the visual arts are quintessentially human endeavors that go to the heart of a sustainable community. [follow the link to read the full article in the Journal of Sustainable Finance & Banking]