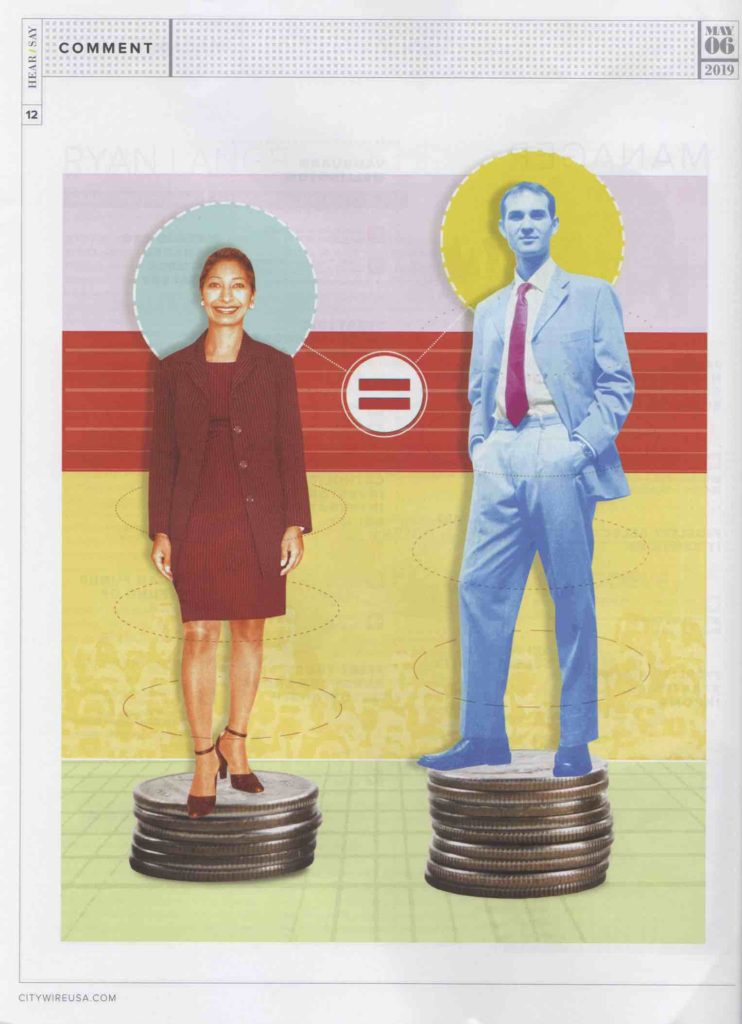

While it may be appropriate to examine pay discrepancies or the imbalance in gender representation in leadership as a starting point, a much deeper examination is required to understand the systems-level constraints preventing equality in the working economy. The naive approach to investing for diversity and inclusion is to simply measure pay parity and the presence of women in the C suite or on boards. Better performance on these metrics may be an indicator of a more progressive enterprise, but it is by no means clearly causal. It could just as easily be that more inclusive companies perform better as it is better performing companies have the latitude to be more inclusive.

From an investment point of view it is necessary to look at everything from HR policies to recruiting and promoting practices to corporate cultures as well as the operational, competitive and other forces that are shaping them. Inclusiveness and equity start at a deeply fundamental level, and comprehensive ESG analysis can be the mechanism for digging to that level and establishing a platform for understanding and engagement to improve performance.

This month’s Citywire column posted in the Library starts to scratch the surface of this challenge, and looks to UN SDG 5 for guidance on what the foundational principles of gender equality and the empowerment of all women and girls looks like in investment terms.