The vibe in the media has certainly changed. In the general and financial press we went from years of indifference to a period of intensifying interest and now we are in the schadenfreude stage. Rather than name-and-shame in this piece, any casual web search will turn up plenty of articles right now pointing out discrepancies, failures, frauds, or simply not living up to the hype. A lot of it is absolutely deserved as a rapidly expanding market is going to have its share of stumbles, but there might be more than a little satisfaction that this movement which is supposed to bring improved ethics and governance, more attention to stakeholders, and more sustainable and even regenerative uses of capital failed to root out companies and offerings that fell short of the mark. But, a free market shaking loose its individual failures is not the same as the market itself failing. In fact, drumming poor solutions out of the market is exactly what should happen iteratively to make the market more reliable.

There is also a certain amount of noise being made about inconsistencies in data and ratings, performance results, etc. with the underlying thesis being that ESG must not actually work or these things would not be so. By that logic nobody should invest in the capital markets at all because they are rife with inconsistencies and not just bad but terrible outcomes for investors. Reductio ad Absurdum.

Uptake of ESG has been incredibly strong, even discounting for flaws in how assets are catalogued. Data demonstrates strong uptake of ESG. The last US SIF Foundation trends report pegged the number in the US alone at $17.1 trillion of $51.4 trillion in professionally managed assets at the end of 2019 (pre-pandemic), a doubling in roughly 5 years and a massive gain in total market share. Part of the challenge in unpacking those figures, as has been discussed before, is how those investable dollars are pegged as “ESG”. Aside from the potential for counting and other process errors in compiling the data, it all gets back to how ESG is defined. And, that is a problem, because trying to define ESG is like trying to define value or art. At the risk of being a little saucy, maybe the best way to explain that is channeling Supreme Court Justice Potter Stewart’s 1964 statement in Jacobellis v. State of Ohio when explaining that there were not words to describe pornography, but “I know it when I see it”.

What does that have to do with peak ESG? In the early days of SRI and then ESG, the community within the marketplace that passionately advocated for it was rigorous in defining their own processes for being sufficiently expressive of ESG principles; but, shall we say, generous in how big the tent was pitched for measuring the total marketplace. Inclusiveness was essential in the earlier years because credibility came along with market representation. The frequent pushback on Wall Street was “nobody actually does this”, which was a real impediment to moving the industry forward. The Street is dominated by trend followers and ESG needed to establish a trend to follow. That meant counts that included dollars that were not administered with the same rigor as the best-in-class approaches of the early adherents. It required counting assets, for example, where some form of shareholder action like proxy voting aligned with ESG priorities even if the assets were not otherwise selected or managed to promote ESG. This reinforced the definitional challenge because the core of standard bearers who would otherwise define ESG with great precision were avoiding being overtly exclusionary.

Fast forward and various societal, environmental and demographic trends converged with growing uptake (and recognition) of ESG investing to accelerate us to where we are now perched atop the $17 trillion mountain. Millennials and Zoomers are applying their consumption behavior to financial services in ways that never existed in prior generations. At the same time, a substantial percentage of Boomers are now thinking generationally about the planetary and societal legacy they leave behind and are rethinking their investments with more sustainable priorities. Wall Street did what Wall Street does and jumped on the trend, and all the firms who were denying there was any substance to ESG were launching new strategies or repositioning old ones to participate. In very short order we shifted from firms being conspicuous by having an ESG offering to being conspicuous by NOT having one.

The hyper-inclusive recognition of ESG assets, and the massive rollout of ESG-aligned products and services along with enterprise-level commitments to benchmarks and targets like the Paris climate accords brings us to this peak moment, but still without the ability to really define what ESG is. That is ok, because it does not necessarily need definition. Importantly, as with a lot of consumer decisions, investors know it when they see it. We have a terrific free market opportunity where we have progressed from extreme scarcity with little from which to choose, however good it was, to an embarrassment of riches. It does require rigorous examination to locate the right solutions for a particular asset owner’s need, but the odds are much better today that the solutions exist.

So, burning with the fires of righteous indignation, people are now throwing darts at ESG and ESG-adjacent strategies under the general principle judge not lest ye be judged. Fair enough, and any firm or strategy espousing standards and practices related to the environment, society and good governance should be able to demonstrate that in their processes and in their results. There are two separate challenges here in the unique space that is the capital markets. The first is a matter of law and regulation. You can’t lie. Whether you are a public reporting company listed on an exchange or a fund managing a portfolio of investments, you can’t lie. That is not an ESG matter, other than simply being bad big-G Governance. The combination of regulators and investors should make quick work of liars, reforming them or destroying them in short order.

Many of the issues under the big ESG tent are not ones of truth though. They are matters of perspective, materiality and quality. As an example, societally and in the markets we are mid-stream in a reckoning about diversity, equity and inclusion (DEI). DEI-informed or activated strategies would fall inside the ESG tent, but where in the tent depends on how DEI is incorporated and what else accompanies it. A company could have a wonderfully diverse leadership and board team, exemplifying the best hiring and recruiting practices in their industry and across the market, and still have a terrible track record on the environment, or workplace safety, or human rights. While there is greater likelihood that a company that performs well on DEI will show well on other ESG factors, it is not an automatic. There might be correlation but not necessarily causation.

It falls to the investor, or the investor along with her trusted advisors, to examine the other factors to decide whether it satisfies the right combination of the constellation of ESG factors to be considered investable. It also falls into that analysis to decide whether the factors being considered actually matter (materiality), and create the desired positive outcomes (quality). Continuing with the DEI case, a company could have better DEI metrics than another company in the market, but not by enough to really change anything. If the average board is a dozen people and the typical company has one woman on the board and the company being evaluated has twice the number of women (2), that is observably better, but is it material if half the population and the workforce is women but representation still doesn’t even break 20%? And it gets more complex – If the company has just implemented a robust plan to diversify its board and will add one woman every year for the next five years, quantitatively today’s figure may not be material but qualitatively the commitment to change could be. That commitment could be the deciding factor between whether going from 1 to 2 women on the board is irrelevant or significant. This is why disclosure and analysis, quantitative and qualitative, are so critical. Numbers do not always tell the whole tale, and scores are an overly simplistic and reductive way to look at an investment’s ESG merits particularly when every investor’s criteria may be different.

ESG is not one thing, and there is no objective standard attached to it. It is aspirational, which means it is as much about where an investment is going as where it is right now. There are also almost innumerable pathways into it. Some investors choose what to own. Others choose what not to own. Some do both. Few agree where the line is. They know it when they see it. Yes, greenwashing is a real problem, but it is essential to distinguish between lies and a lack of clarity and understanding. Regulators need to tackle the lies, and the financial services industry needs to tackle the clarity and understanding. Just like Sy Syms used to say sartorially, an educated consumer is the best customer. Then the free market will do the rest. We are moving out of the period of breathless hyperbole and bandwagon adopters and into a phase of discipline, critical analysis, and market reordering. There will be winners and losers and what is and is not counted will change, but the real commitment to principles of sustainable and responsible investing is still in its early stages. Now the trend emerges from the bubble.

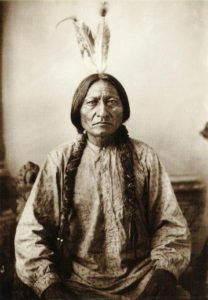

The news cycle has certainly spoken for itself in the last few months and the last few years. So, from the great Lakota leader Sitting Bull, who coincidentally was killed at Standing Rock: “They claim this mother of ours, the earth, for their own and fence their neighbors away; they deface her with their buildings and their refuse. The nation is like a spring freshet; it overruns its banks and destroys all who are in its path.”

The news cycle has certainly spoken for itself in the last few months and the last few years. So, from the great Lakota leader Sitting Bull, who coincidentally was killed at Standing Rock: “They claim this mother of ours, the earth, for their own and fence their neighbors away; they deface her with their buildings and their refuse. The nation is like a spring freshet; it overruns its banks and destroys all who are in its path.”