Diversity, Equity and Inclusion – that is a lot to pack into one three-letter acronym, and therefore DEI faces a similar uphill battle to ESG for community comprehension. DEI also covers a significant swath of investment considerations that fall broadly under various ESG frameworks. This family of topics had a moment in 2020 when the collective historical trauma expressed in MeToo/Time’s Up, Black Lives Matter, Land Back, and other social movements converged with the newfound trauma of (and free time and free attention created by) COVID. It was at long last the Emperor-has-no-clothes moment for entrenched power structures from companies to governments. Personality-driven takedowns have dominated the news cycle, and probably unhelpfully pulled attention away from the systems-level challenges by casting individuals rather than institutions in the role of villain, but companies have taken heed and are at various stages of attempting to address internal processes and external imaging around the people processes that make up their enterprises.

ESG and impact investors have been using the flow of capital to improve fairness, access and opportunity for all since long before it became a leading focus of conversation about companies right behind (and in numerous cases right in front of) climate change and the environment. Having been interviewed twice on the topic in the span of a week, and having to articulate what conscious investors are thinking about DEI, some clarifying thoughts were stimulated for me that I thought should be written down for posterity and hopefully action.

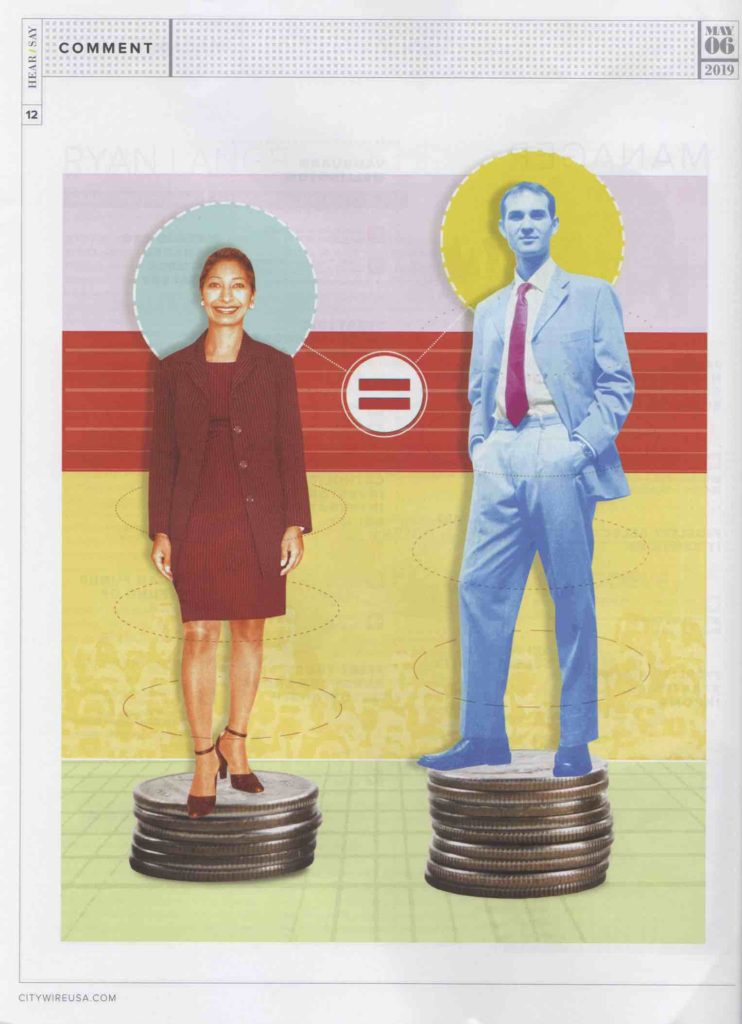

We are creating and then not resolving tensions around people in the corporate setting. On one hand we want to blind human resources processes to race, creed, color, religion, orientation, and gender, and let core competencies drive hiring, incentives, promotions, reviews, etc. On the other hand we want to shine the spotlight on these distinctions and celebrate individuality and diversity with the belief that out of a diverse workforce comes greater innovation, productivity, collaboration, and ultimately profit.

Data is a big part of this. For years it has been a maxim that corporate transparency is a proxy for overall good ESG performance, or at least a leading indicator. There is information in the active decision not to disclose that casts a company in a poor light. So, now we have data. A lot of data. We crave even more data. And data can be indicative. It can give a point-in-time view of a company’s DEI performance relative to the population at large. In other words, does the company look like its community, its customers, its partners, and its suppliers? It can give insight into trajectory as well. Is the company improving in terms of diversity, equity and inclusion over time?

The challenge with a data-centric approach to investment decisionmaking in this context is that it dehumanizes the very person-centric considerations wrapped up in DEI. We reduce people to observations that go on a check list. Rather than looking at the richness and complexity of an individual or a team of individuals, we tick boxes – Woman, check. Brown, check. LGBTQ2SIA+, check. I have heard it said in largely unrelated contexts that, as a corporate community, we have created edifices that obscure the humanity of workers, of people, by calling them “human resources” or “human capital”, as though people are nothing more than raw material that goes into the corporate machinery in order to manufacture profit. Now we are reinforcing that tension by being primarily data-driven in our scrutiny of DEI performance.

Data partially answers the question of who is doing better, but without asking whether that was an accidental byproduct or the outcome of a culture and a set of processes that inherently overcome systemic bias. Data can demonstrate correlation – the company’s performance improved as its workforce became more diverse, or the company became more diverse as performance improved – without demonstrating causation. Did the company take its success as an opportunity to make their workforce more diverse, equitable and inclusive? Or did better DEI performance unlock additional value for the company?

Disclosure, and our examination of it, needs to go beyond counting heads, and provide insight into the processes that make a company more person-centric. We also need more insight into what companies are doing to improve their access to a representative workforce, and also improving access of the representative workforce to employment opportunities. Often we hear that “there just aren’t enough qualified X candidates for this specific role or this level of seniority, so we looked at as many diverse candidates as we could but the sample was so small we couldn’t make the diverse hire.”

Do companies take a long-term view of their workforces and recruit a representative cross section of people and then cultivate and develop them over time, training and rotating and promoting until there is a full pipeline of qualified individuals for all jobs at all levels? Do companies recruit at HBCUs and Indigenous Universities? Do companies collaborate with academia to promote a diverse and representative student body majoring in every needed discipline? Are companies hiring and evaluating only around proven experience, which is skewed by the limited opportunities diverse workers can access, or are they seeking and promoting on skills, aptitudes, and ability and willingness to learn? Are companies looking at their internal cultures, policies, locations, etc. and looking for ways to improve that two-way access, like proximity to diverse communities, flexible work hours and leave policies for parents and caretakers, training and development including tuition assistance, and open hiring?

In other words, are companies treating the lack of representative candidates as an externality that can’t be changed, only managed, or are they taking ownership for changing the system?

There is another critical factor that does not get enough attention, and that is what the early lifecycle of a company looks like. Evaluate companies for DEI attributes the same as we do individuals – look at the origin stories. The capital markets do an entirely insufficient job of providing access and opportunity to diverse and representative founders and leaders of early-stage companies. It seems reasonable to expect that founders that look like the population at large are more likely to create companies that look like the population at large. Private investors still unabashedly focus on the “bros” because they have historically had the access and therefore the seasoning to go through the mill and get funded. Investors like track records, so we need more people with track records. Many of the most successful and acclaimed companies right now were not even a glint in their founders’ eyes a decade or two ago, and now they are worth billions and hire millions.

Much the same as building more diverse, equitable and inclusive workforces, it will take less than a decade to identify, fund and promote startups where DEI is their DNA, and that will rapidly grow into the next generation of high performing companies. This is well within the time horizon of private and institutional investors, and could catalyze a much deeper, systems-level change that turns the entire market through success, competition, growth and profit.