Well, the Earth isn’t particularly happy, and we aren’t so happy about what is happening to the Earth, so perhaps we should rephrase that to be Wishing You a Day of Concerned Observance for the Earth.

Today it seemed appropriate to come back to a recurring theme at RIS, that being the idea of the commons. We have been stuck with this notion that caring for the planet comes at the cost of truly free commerce. Underpinning that notion seems to be the sense that taking from the planet comes at no cost other than the expense of obtaining the license to exploit and the costs of the materials and processes to execute on that taking.

What we all need to recognize is that everything comes at a cost. Even if you subscribe to the notion that humans are the supreme beings on this planet, or even that only certain humans are supreme, that cost is socialized among us. If a factory belches GhGs or heavy metals into the air, we all share in that one atmosphere and the consequent health effects. If an oil well dumps millions of barrels of oil into the ocean, coastal communities and fisheries pay the price. If the water supply is polluted or overused, it is the citizens of Flint, Michigan or Charleston, West Virginia who get poisoned or the farmers of Nebraska or California who can’t grow productive crops. The consequences to access to clean water, breathable air, farmable land, fishable waters, safe and healthy food, clean beaches, and sharable wildernesses are shared by all.

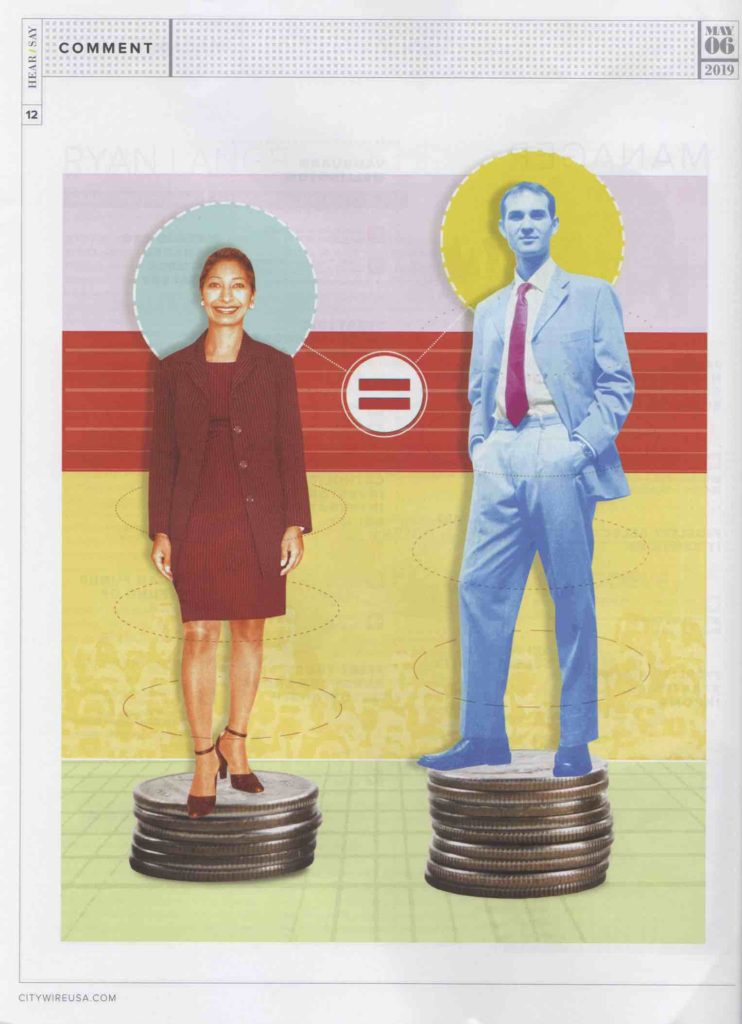

In a free and fair market, people are compensated for taking risk, providing labor or sharing resources. But, the reality is people are not adequately compensated individually or collectively for the use of our commons. Our shared environment within our communities, our countries, and across our planet is being exploited with little concern for what it actually costs. Put aside for the moment you care about oily birds and homeless polar bears. If the market actually priced what it costs just human society for the uncompensated taking of our natural environmental resources in terms of health, welfare and prosperity, it would be far too expensive to sustain.

As long as it is cheap or free to take oil, coal, natural gas, minerals and water from our public lands, or to fill our public waters and public air with garbage and pollutants, this problem will never be rectified. The cost of doing business and the cost of capital need to take into account all of the costs for our people and our planet. What is the price for the use of our commons? Will they pay it? If not, they should lose their licenses to operate. Other businesses will take their places that serve the same needs but better consider the interests of all stakeholders. That is how a truly free market works.